Have you ever felt like you’re a bit behind in the crypto world like everyone else who is earning money while you’re just looking at charts? Perhaps you’ve heard of crypto arbitrage but you weren’t sure whether it’s true dangerous , risky or too complex. There are plenty of people who are trying to determine whether there’s a better and faster method to trade.

The Crypto Arbitrage Guide will break it down in simple English. You’ll discover how to recognize price differences between exchanges the way it is done and what tools can assist you in doing it in a safe manner. You may be just interested or are ready to explore it out this guide will give you the complete picture without all the jargon.

How Does Crypto Arbitrage Work?

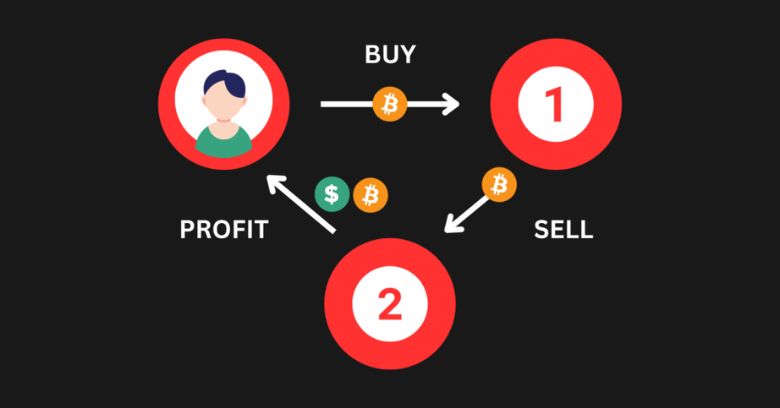

Crypto arbitrage guide is a method of taking advantage of price differences between exchanges for cryptocurrency. The traders buy at a low price on one exchange and then sell for high on a different. This is due to market fragmentation inefficiencies of the crypto market and different liquidity on exchanges. This opens up arbitrage opportunities for traders with experience.

There are a variety of arbitrage trading strategies including triangular arbitrage cross exchange arbitrage and flash loan arbitration. Traders employ tools such as arbitrage calculators as well as automated trading systems to make transactions quickly. Factors such as network congestion, gas costs and processing times for withdrawals could affect the results. The success of crypto trading is contingent on a strong control of risk when trading in crypto particularly, when there is a high volatility in the crypto market and a low volume of trading on exchanges.

Does Crypto Arbitrage Really Work?

Crypto arbitrage is a good option in the event of real price variations between centralized and exchanges that are decentralized. Traders employ smart arbitrage strategies such as triangular arbitrage and cross exchange arbitrage to make small gains. The profits are quickly accumulated thanks to cryptocurrency trading bots as well as automated systems for trading.

The system is more effective when there is a high degree of volatility in the crypto market with a high liquidity of exchange and a low rate of cost of trading and fees. However delays caused by grid congestion and high gas costs or processing times for withdrawals can make it difficult to earn profit. Risk management is a must when trading in crypto and precise arbitrage calculators are essential to the success of crypto trading in a constantly evolving regulatory environment as well as during rapid price changes.

Types of Crypto Arbitrage Strategies

Crypto arbitrage is one of the most effective ways to gain from the price differentials in cryptocurrency. One of the most popular methods is cross exchange arbitration in which traders buy at a low price on a central exchange and sell for a premium on another. It is most effective when fees for trading as well as withdrawal delays and network congestion are minimal. This type of trading is straightforward and efficient when liquidity is high and the price changes are fast.

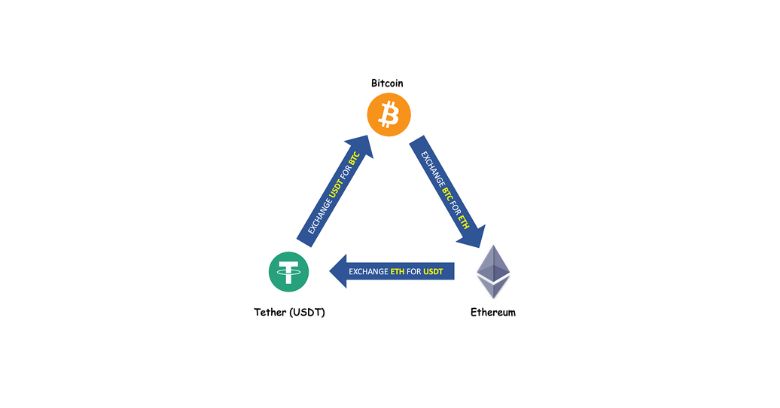

Advanced users typically utilize triangular arbitrage also known as flash loan arbitration. Triangular arbitrage is a trade with three pairs in order to earn modest gains. Crypto flash loans allow rapid trades by borrowing funds with no collateral backed by smart contracts that are based on exchanges that are decentralized. These strategies require fast devices like arbitrage bots or automatic trading platforms. The traders also monitor the exchange rate assets prices and trading volumes on exchanges to identify significant arbitrage opportunities in the ever changing crypto market.

Spatial Arbitrage

Spatial arbitrage is an easy method of crypto arbitrage guide that makes use of price variations between two exchanges. An investor purchases an asset such as Bitcoin or Ethereum through a central exchange and then trades it on a different exchange at the same price. This strategy of trading is effective when the network is congested or gas charges are low as well as withdrawal times are minimal.

To reap the benefits of the use of spatial arbitrage in trading investors must have powerful tools such as arbitrage calculators arbitrage bots and quick cryptocurrency asset transfers. The success of this strategy is also dependent on liquidity in exchanges low charges and fees for trading as well as a minimal amount of slippage trading. This approach is used in both decentralized and central exchanges particularly during volatile crypto markets and rapidly changing exchange rates.

FAQ’s

Is crypto arbitrage still possible in 2025?

Yes crypto arbitrage is feasible with the help of fast and intelligent trading tools until 2025.

Is crypto arbitrage still profitable?

It could be profitable If you manage fees as well as slippage and you take action swiftly.

Which platform is best for arbitrage trading?

The top platforms offer great liquidity and have low fees such as Binance and Coinbase.

Which stock is best for arbitrage?

Stocks that have high volatility and price spreads across markets are the best.

Which would be the easiest to arbitrage?

Most well known cryptocurrency like Bitcoin as well as Ethereum are the easiest to arbitrage.

Conclusion

This Crypto arbitrage guide offers the clearest way of understanding how to identify and exploit price variations between cryptocurrency exchanges. Through learning about the most effective strategies such as cross exchange arbitrage and reducing risks like the cost of trading and network congestion traders are able to increase their profits. Utilizing automated trading systems and sophisticated tools traders can navigate the ever changing cryptocurrency market. With careful planning and risk management the crypto arbitrage market remains an effective trading strategy for novice and experienced traders through 2025 and even beyond.

.