From its bullish 2024 outlook to its current position as a “good buy” in the real-world asset (RWA) tokenisation space, Rexas Finance (RXS) has seen a significant turnaround. Following its high-profile exchange launch in mid-2025, RXS is currently in a significant growth period leading up to February 2026.

An overview of the Current Market

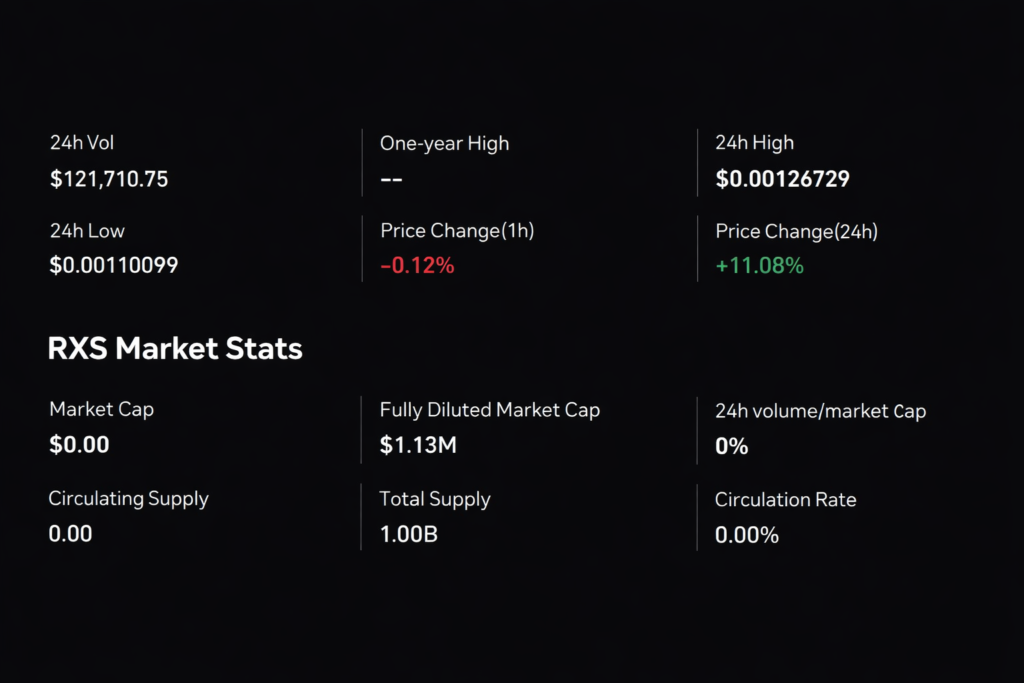

| Current Price: | Around $0.00125 |

| 24-Hour Change: | +12.3% (recent indications of life) |

| 24-Hour Volume: | Around $116,000. |

| Market Status: | Trading on Uniswap, BitMart, LBank, and MEXC. |

From Launch Hype to Market Reality: Price Analysis

After a multi-stage launch that ended at $0.20 per token, Rexas Finance raised nearly $55 million to enter the market with a serious challenge. The “moonshot” phase was expected to see prices as high as $5 or $10, but reality took an unexpected turn after the launch.

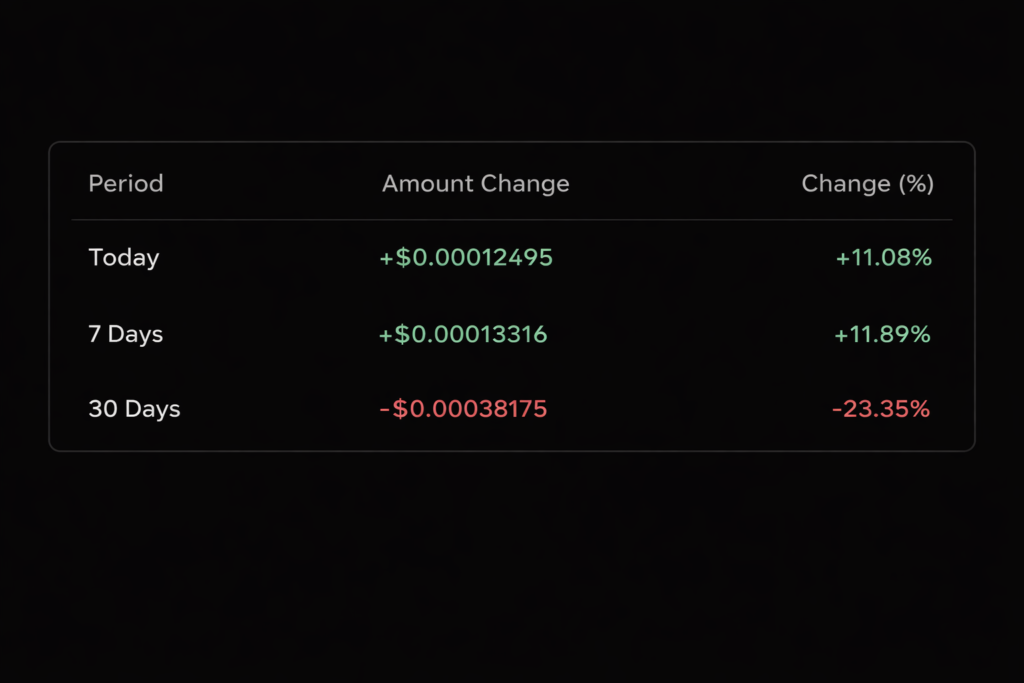

Following its peak on 19 June 2025, RXS was under intense selling pressure as market participants cashed in. By early 2026, the price was near its current low of $0.0012. Still, recent technical indicators on the RXS/USDT pair point to a “top-out” pattern, with a one-day increase of over 12% suggesting that larger and more market interest could be on the way.

RXS Price Data

The current price of Rexas Finance (RXS) is $0.00125299. With a daily trading volume of $105,254.03, the market value is at $0.00. Rexas Finance has a floating supply of around 0.00 and has increased by 11.08% over the last few days. These figures are based on the latest market data at the correct time.

Conversion Rate for Rexas Finance (RXS)

Technical Analysis for RXS

Strong technical indicators, such as volume strength and exponential moving averages (EMAs), underpin current RXS cryptocurrency price predictions. These tools help traders identify price support and resistance, as well as short-term price movements. According to CoinMarketCap data, RXS shows continued demand during market declines.

Experts monitoring Rexas Finance use technical analysis techniques to identify trends and entry points in cryptocurrency prices. RXS tokens’ price patterns align with Ethereum and the broader altcoin market, as they are ERC-20 tokens on the Ethereum network. Long-term growth and market sentiment are also influenced by high levels of interest in staking pools, token burns, and institutional acceptance. Always DYPR (Do YourPersonal Research) before investing in volatile tokens.

Disclaimer

Cryptocurrency prices are subject to significant market risk and volatility. Investments should only be made in products that individuals understand well. The information provided on this page is for informational purposes only and does not constitute investment advice or recommendations. Cryptowithus disclaims any responsibility for the accuracy or completeness of the information, which is obtained from third parties. Users are advised to refer to the Cryptowithus Terms of Use and Risk Disclosure for further details.

FAQ’s

Can RXS reach $100?

RXS could be $100 if it is adopted and the market continues to grow.

Is RXS crypto a good investment?

RXS is promising with real world application and solid DeFi support.

What is the price prediction for RXS in 2025?

In the year 2025 RXS will likely rise substantially If trends in the market and utility trends continue.

What is RXS crypto?

RXS represents a cryptocurrency created by Rexas Finance focused on real world tokenization of assets.

What is the potential of RXS?

RXS has a lot of potential in the DeFi and RWA markets and growth in token utilityto climb.